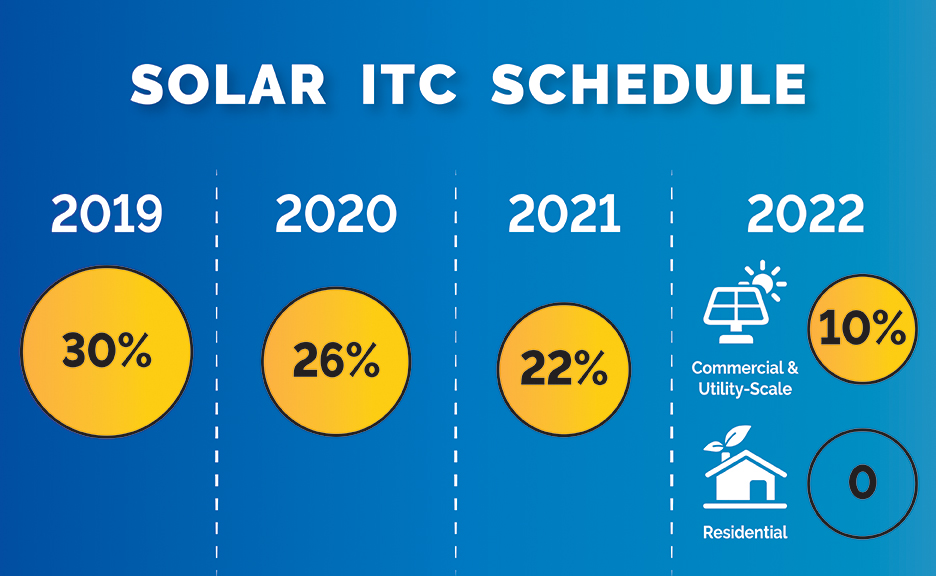

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Solar investment tax credit calculation.

A cash purchase has benefits like using the investment tax credit and depreciation benefits of solar but not everyone has the ability to buy solar panels with cash upfront or use a lender.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the us by 2015 and they predict we will have nearly 100 gw total by the end of 2020.

Economy in the.

Right now the solar investment tax credit itc is worth 26 of your total system cost.

This includes the value of parts and contractor fees for the installation.

The itc applies to both residential and commercial systems and there is no cap on its value.

The history of the solar investment tax credit.

However you cannot claim a tax credit if you are a renter and your landlord installs a solar system since you.

The gross system cost includes any improvements needed to facilitate the installation of a solar system such as electrical work roof work etc.

Currently the itc is 30 of the gross system cost of your solar project.

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

Thanks to the popularity of the itc and its success in supporting the united states transition to a renewable energy economy congress has extended its expiration date multiple times.

Since the itc was enacted in 2006 the u s.

In this case the amount you spend contributing to the cost of the solar pv system would be the amount you would use to calculate your tax credit.

If you are grid tied or participate in net metering the power generated at your facility is placed as a credit to your energy bill.

The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states.

The itc was originally established by the energy policy act of 2005 and was set to expire at the end of 2007.

How to calculate the federal solar tax credit.

The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st century energy systems and technology.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.